Framingham, MA-based Staples Inc. said on Wednesday that it entered into a deal to be acquired by New York-based private equity firm Sycamore Partners in a deal valued at $6.9 billion..

The office supply retailer said investment funds managed by Sycamore Partners will acquire the company in the transaction.

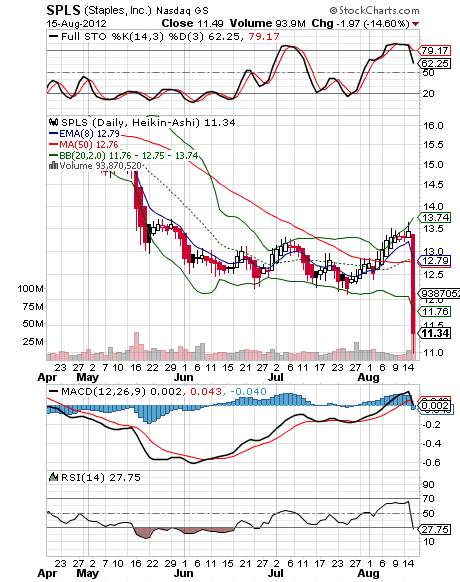

Company shares have lost about 22 percent of their value over the past five years as the retailer has been met with increasing online competition and a challenging environment for brick-and-mortar stores

Under the terms of the merger agreement, all Staples’ stockholders will receive $10.25 per share in cash for each share of common stock they own, which represents a premium of approximately 20 percent to the 10-day volume weighted average stock price for Staples shares for the period ended April 3, 2017.

Staples said that its board of directors unanimously approved the merger agreement and recommends that all Staples stockholders vote in favor of the transaction.

The deal is subject to regulatory and stockholder approvals and is expected to close no later than December 2017, the company said. The closing is not subject to a financing condition.

The company recently reported that total sales for the first quarter of 2017 were $4.1 billion, a decrease of 5 percent compared with the same time period a year earlier. The company closed 18 stores during the first quarter of 2017 and ended the quarter with 1,237 stores in the United States and 304 stores in Canada.

Staples has been retooling its business since its failed takeover of rival Office Depot last year. Reuters reported in May that Sycamore was one of two firms actively exploring an acquisition of the retailer.

Recent Sycamore Partners acquisitions:

- The Limited - Won auction in 2017 for $26.8 million.

- talbots - Acquired in 2012 for $391 million

- Stuart Weitzman - Acquired in 2014 for $2.2 billion. Sold to Coach, Inc. in 2015 for $574 million.

- Nine West - Acquired in 2014 for $2.2 billion.

- Jones New York - Acquired in 2014 for $2.2 billion. Sold to Authentic Brands Group in 2015.

- Hot Topic - Acquired in 2013 for $600 million.

- Coldwater Creek - Acquired in 2014.